Thanks to all those churches who participated in the first CCFS Customer Insights Survey. Your feedback will become an important reference point as we continue to improve and develop what we do.

Overview of Results:

The survey was limited to Victorian and Tasmanian affiliates and here is a summary of the key aspects of the survey:

- 65% of respondents were churches with under 100 regular attendees. 62.5% of respondents had income under $125,000.

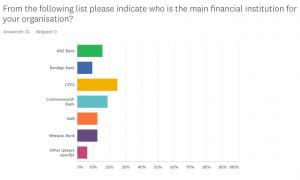

- CCFS was the most common ‘primary’ financial institution amongst respondents (25%) with the CBA in 2nd place (18%).

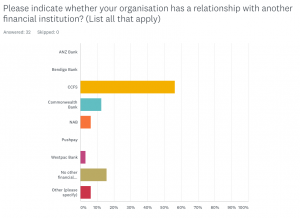

- Over half of those churches who had a ‘primary’ relationship with a financial organisation other than CCFS used CCFS as a secondary provider (56%), mainly for specialised products and services.

- The most popular products and services are the Minister’s Expenses Account followed by the LSL Accumulator and loans.

- The most popular products with other financial institutions (other than a transactional account) are corporate credit cards and cash management accounts.

- Those respondents that have their main relationship with another financial institution do so mainly because the branch is convenient (58%) and/or they have “always used them” (54%) (multiple answers were allowed).

We are greatly encouraged by the number of churches that support mission through the utilisation of CCFS products and services and we continue to look for ways to serve churches more effectively.

Likes & Dislikes

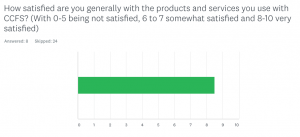

- CCFS customer service – the most liked aspect was our great customer service. The team was rated with a score of 9.5 and reflects their genuine commitment to looking after the needs of our customers. Well done team!

- Product & services – There was also strong recognition of the products and services offered by CCFS which resulted in an overall Product and Service satisfaction score of 8.5

- The missional aims of CCFS – These were also a prominent feature of responses. Respondents appreciated our Not-for-Profit ethos, low fees and the commitment to supporting Churches of Christ churches.

We are also grateful to those churches that gave guidance on how we can improve. Some of the major areas identified included:

- CCFS Online – Some found that the use of CCFS online was difficult, particularly in relation to batches. We are currently looking at ways to streamline this further and will hopefully reduce and inconvenience being experienced.

- Need for more information – this was requested both for batch payments and on statements. We will continue to work with our service partners to enhance these features

- Greater communication: Many said that they wanted to know more about our products and services and what we do.